If you’re refinancing in a falling interest rate environment, you may be able to take advantage of interest savings as a bonus. Use Ratehub.ca’s refinance calculator to determine your maximum equity and the corresponding penalty. Unfortunately, accessing this equity comes at a cost – your lender will charge you a penalty for breaking your mortgage early. In Canada, mortgage holders can access a maximum of 80% of their home's value, less any outstanding mortgage balance. If refinancing for equity, the first thing you want to determine is the maximum amount of equity you can access. Many lenders will allow you to borrow from them using your home equity as security for the loan - this is what accessing your equity is all about. Your home equity is calculated by taking the current value of your home, then subtracting from that your outstanding mortgage amount. Refinance to access home equity as cashĪs you pay off your mortgage, you'll gradually build up equity in your home. This penalty is charged by your lender for breaking your mortgage contract early, and is based on your original contract date, current mortgage balance, mortgage rate and other factors. As most mortgage brokers and lenders will cover your legal costs, the main cost you need to worry about is your break of mortgage penalty, known as the pre-payment penalty. To determine if you can save money with a lower mortgage rate, use our calculator to compare the monthly interest savings against the cost to refinance. There are two main reasons you’d consider doing a refinance: To lower your existing mortgage rate, or to access the equity you’ve built in your home as cash. If you're refinancing your mortgage while you're in the middle of an existing mortgage term, you're likely to be hit with a pre-payment penalty - more on that below. You can do this with your current mortgage provider or switch to another.

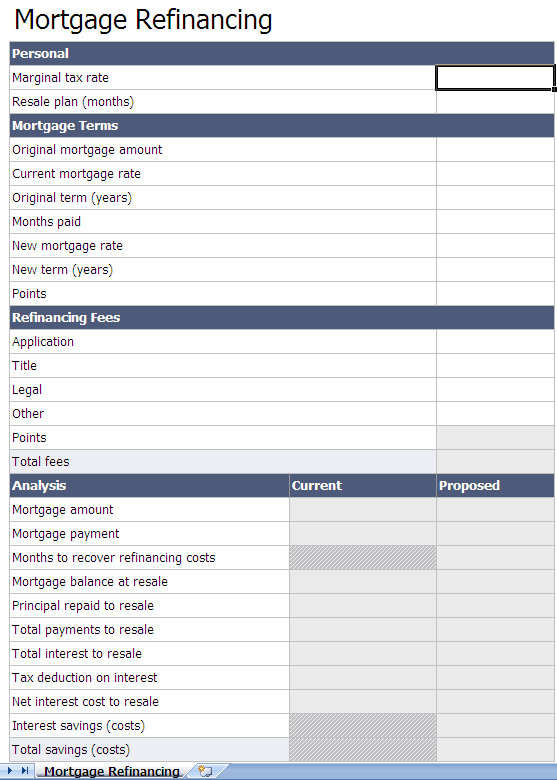

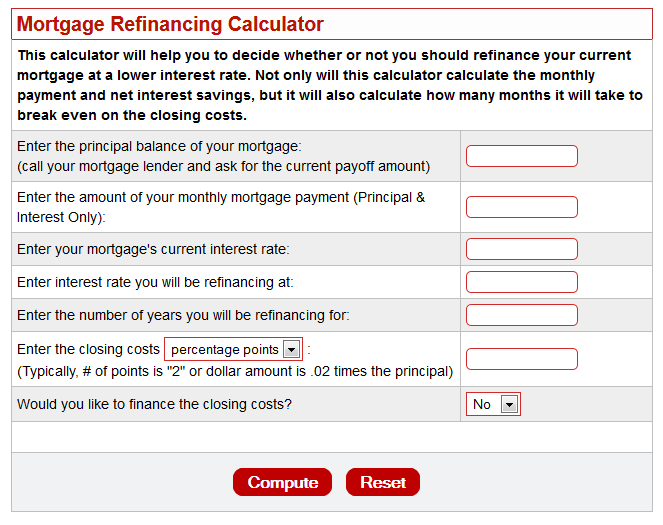

Refinancing a mortgage is when you end your current mortgage and start a new one. While there are some non-financial reasons you might want to refinance your mortgage, our calculator gives you the information you need to start making a decision. The mortgage refinance calculator above will do the hard work for you, estimating the penalties associated with refinancing as well as the potential savings you'll make from getting a new mortgage at today's rates. As a result, it's important to understand how much a mortgage refinance will cost you before you pull the trigger - that's where a mortgage refinance calculator comes in handy. However, there are costs associated with refinancing that can outweigh any potential savings you might build. Refinancing gives you one payment, interest rate and monthly due date.Refinancing your mortgage can be a really valuable option as a homeowner. From there, you’ll make one payment to your new loan. You want to simplify your student loan payments. If you have many different loans, refinancing will give you a new loan and repay all your old loans. If you refinance those loans, you lose access to this benefit. 30, 2021, which suspends payments and interest rates. You have private student loans. Federal student loans are under forbearance through Sept. If you can’t prove that you can repay your loan, you might not get approved. As you complete your application, you’ll be asked about your current employment. When you take out a new loan through refinancing, you’ll need to prove that you can pay it back. You’re financially secure. Millions of Americans have lost their jobs or face reduced hours. Refinancing right now might be a good idea if:

However, refinancing rates have plummeted during the recession, allowing many Americans to secure lower interest rates than what they were paying before. The global pandemic has brought on a host of financial issues for people across the world. What to do when you lose your 401(k) match Should you accept an early retirement offer? How much should you contribute to your 401(k)?

0 kommentar(er)

0 kommentar(er)